U.S. stocks have rallied over 20% in just a matter of months. Questions abound over whether sitting on the sidelines means you’ve “missed it.”

History tells us that investing when the market is at an all-time high often spells for solid future returns. Over the last 50-odd years (going back to 1970), if you invested in the S&P 500 at all all-time highs, your investment would have been higher a year later 70% of the time, with an average return of 9.4% – versus the 9.0% on average when investing at any time.

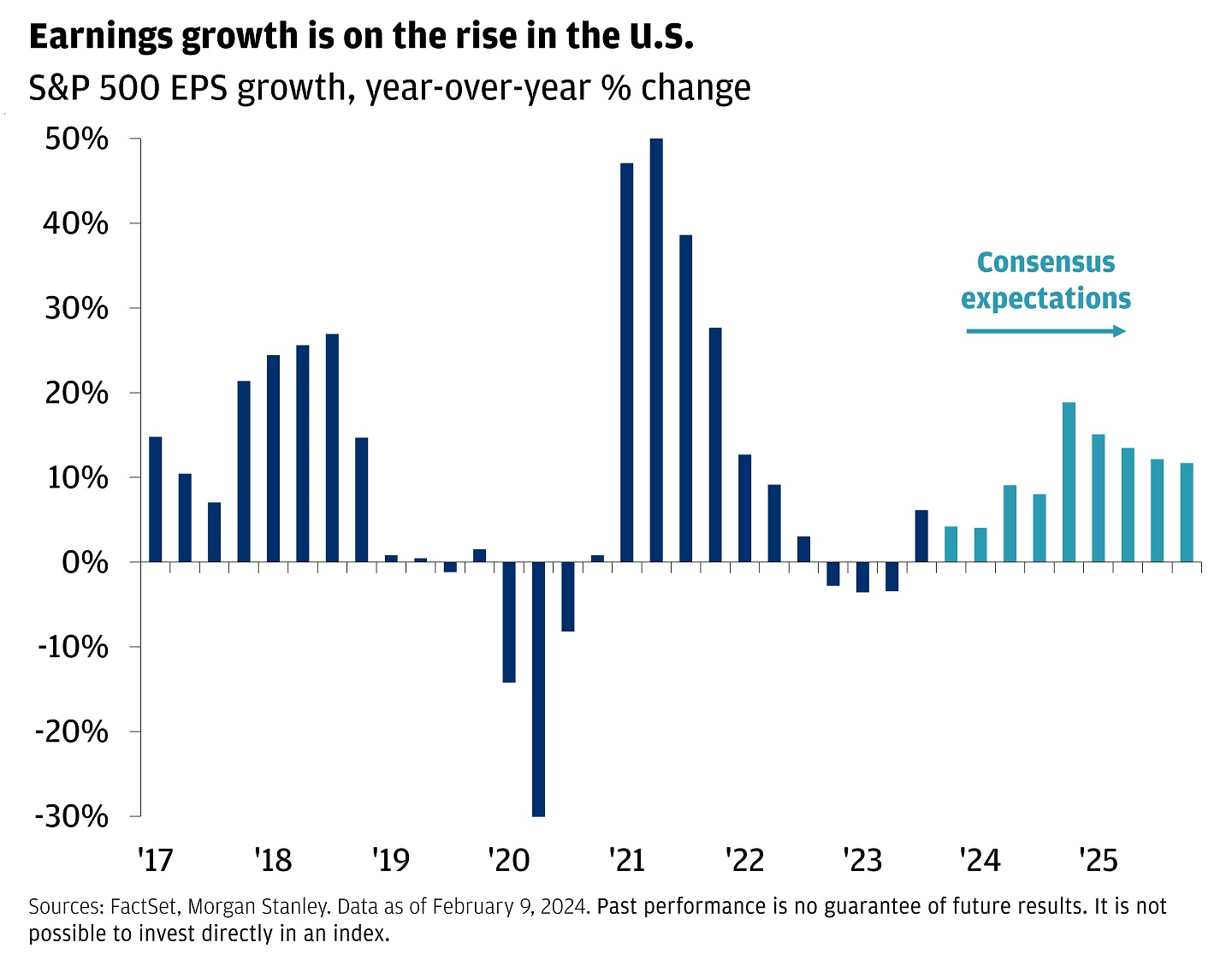

We also think that today’s backdrop is a good one for stocks. Some inflation (i.e. headline CPI within a 2%–3% range) tends to be good for corporate earnings. Indeed, this Q4 earnings season stands to mark a second straight quarter of growth after almost a year of contraction. Stellar results from big tech have shown those companies as worthy of their rallies. Nvidia overtook both Alphabet and Amazon this week to become the third largest company in the world. Meanwhile, other sectors are also joining in. Since late October, the equally-weighted S&P 500 has kept pace with the market cap-weighted index, and small caps have actually outperformed.